Out of the 1,043,284 euros disbursed by the Bureau, the institution is unable to trace the recipients of these funds. In simpler terms, no one knows where the money ended up. These payments were made during 2022 (59 cases) and 2023 (107 cases) as compensations for border insurance claims and under Memorandum of Cooperation. However, the Bureau lacks the necessary supporting documentation such as details of the damage, police accident reports, decisions by damage assessment committees, expert reports, or other corroborative documents that would justify these payments.

This finding is one among many uncovered by the internal auditor during a financial and compliance audit carried out between December 2024 and January 2025, a report provided to Preportr.

According to the report, these payments were not recorded in the damage database, leading to a major discrepancy between the bank account expenditures and the compensation-related documentation. When approached, the Finance Department could not produce any supporting evidence regarding these identified payments.

The Finance Department was contacted to provide evidence of these payments, but no supporting documentation was made available to the audit for the identified transactions.

“The lack of clear documentation makes it impossible to verify whether these funds were genuinely used to compensate actual damages or were diverted for other purposes, raising serious concerns about the management of compensation funds and the overall transparency of the process”, the internal audit report states.

Among other issues, the audit noted that this mismanagement could expose the Bureau to financial mismanagement risks, non-compliance with regulations and accounting standards, potential fund abuse, and penalties from regulatory authority.

In connection with this finding, the internal auditor stressed that there could have been violations of the Insurance Law, the Law on the Prevention of Money Laundering and Terrorism Financing, as well as the Law on Tax Administration and Procedures.

Within the report, Bureau management responded in the comment section, noting that the relevant parties had already been informed of these discrepancies through this draft report.

‘We recommend that this matter be addressed at the General Assembly, in order to take the necessary actions to verify the key circumstances that resulted in the compensation of these damages,’ their comment further states.

At a meeting on February 24, 2025, the Internal Audit Committee of the Kosovo Insurance Bureau approved the audit report and recommended that the Bureau’s General Assembly forward two issues identified in the internal audit reports, each representing legal breaches to the competent authorities:

1. Issue 1: Unsubstantiated Expenses in Damage Payments – from the Audit Report on the Handling and Payment of Claims for the period January 2019 to June 2024.

2. Issue 2: The Transfer of Funds to Employees’ Private Accounts and the Use of Cash Transactions for Operating Expenses for the period 2019-2023 – from the Audit Report on the Expense Process for January 2019 to June 2024.

Former finance director takes responsibility

In relation to the suspicions of misappropriations uncovered by the internal audit, the former finance and accounting director at the Bureau, Valon Berisha, has self-reported. Typically, when irregularities are detected, employees tend to deflect responsibility. In this case, however, Berisha has accepted full accountability.

Furthermore, on March 10, 2025, through his lawyer Fanol Krasniqi, he sent a letter to the Bureau proposing a settlement to cover the damages. The case concerns one million euros, the source of which remains unaccounted for.

Preportr has obtained this proposal document, to which Berisha has attached a written statement made by him through his lawyer.

In his statement, Berisha who resigned from his position in June 2024, explained that as finance and accounting director he was solely responsible for organizing, controlling, and executing financial operations. This included making decisions regarding transactions, payments, financial reporting, and any other processes involving the management of the Bureau’s funds and resources.

"No other employee, including those in managerial or executive positions, had access to, knowledge of, or involvement in the financial decision-making processes undertaken by me. Every action taken was within my responsibilities and professional discretion, without any influence or interference from others within the Bureau," Berisha stated in his declaration.

In this declaration, he emphasized once again that no other employee, regardless of their position, was involved in or had any knowledge of those processes, and that they cannot be held accountable for the financial actions or decisions.

“Any decision or potential misappropriation that occurred during my tenure was my responsibility, and had no connection to other individuals within the Bureau, who were neither informed nor involved in these processes”, Berisha declared.

An initial offer of 100,000 euros

In his proposal to negotiate a settlement for the damages, communicated through his lawyer, Fanol Krasniqi, it is stated that there is a willingness to compensate for the loss. According to the proposal, this is a good opportunity for the Bureau to recover funds through a prompt and efficient settlement, minimizing expenses while ensuring fulfillment of the obligation. The proposal suggests that negotiations on the settlement terms should begin immediately so that the issue can be resolved.

“To guarantee complete and effective fulfillment of the obligation, we request that the Bureau consider agreeing to pay the sum determined by your financial expertise in several installments, and as a goodwill gesture, we express our readiness to pay up to 100,000 euros for this initial tranche,” the proposal reads.

Fanol Krasniqi, Valon Berisha’s lawyer in this matter, told Preportr that so far they have not received any response from the Bureau regarding the settlement proposal.

“We have been waiting for an invitation to a meeting during which we can request an expert assessment, because the actual damage might be even half of what has been reported. The Bureau might prefer to settle rather than entertain other options,” Krasniqi explained.

The Bureau’s silence

The Kosovo Insurance Bureau has yet to comment on the internal audit findings or on the proposed compensation settlement by Valon Berisha. In its response, the Bureau stated that the relevant documents are classified and part of an ongoing legal process, and any comments might interfere with these proceedings.

“What we can say is that, on our part, all issues are being handled in full compliance with applicable legislation”, the Bureau noted.

Despite repeated inquiries, the Bureau has not provided any information on the stages or steps through which a payment or transaction should be processed, nor whether it falls solely under the discretion of the finance director or also requires the signature of the executive director. Typically, in institutions as well as other organizations, such payments and transactions are subject to at least two levels of hierarchical approval.

The Bureau also mentioned that it has engaged lawyer Arian Koci to address this matter. Koci stated to Preportr that the internal audit findings have been forwarded to the prosecutor’s office. He declined to provide further details regarding the claims made through the criminal complaint.

"Since we do not have investigative capacities, we have requested that the same authorities, within the framework of their investigation, examine whether there might be any additional issues related to the suspicions of misappropriation. I cannot comment on the criminal complaint, as it is now in the hands of the prosecutors, who are responsible for further development of this case”, Koci said.

The Prosecutor’s Office in Pristina informed Preportr that the matter is still in the investigative phase and that, for the time being, they cannot provide detailed information in order to avoid compromising the integrity of the inquiry into the case.

"Central Bank closely monitoring the situation"

Regarding the findings of the internal audit, the Central Bank of Kosovo (CBK) informed Preportr that following an earlier examination and subsequent measures, it had ordered the Bureau to conduct a full internal audit and review of several processes – including claims handling, payment procedures, Bureau expenses, and employment as well as compensation processes.

According to the Central Bank, the Bureau has submitted the requested report and information.

“Meetings have been held with the relevant departments of the Bureau to discuss the issue and ensure that it is properly addressed. To date, some measures have been implemented while further decisions are pending, which are currently being finalized by the Bureau and the competent institutions. The Central Bank is monitoring these developments closely”, the CBK response states.

However, regarding the finding of 1,043,284 euros, the Central Bank was reserved in its comments. The institution stated that the findings relate to the period of 2022-2023 and that such discrepancies have been addressed, with no such issues observed for 2024 and beyond.

“The measures already taken by the Central Bank have produced results in terms of governance and accountability, and for that reason, the Central Bank remains committed to ongoing oversight. These measures affected all executive bodies and have led to changes in internal organization,” the response from the Central Bank noted.

Nevertheless, the Central Bank did not specify what further actions have been taken following these findings.

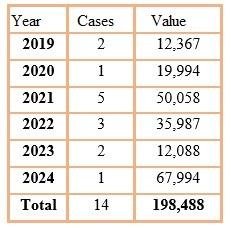

Around 200,000 euros paid without the original police accident reports

The internal audit found that in 14 cases, damage compensation was processed with incomplete documentation, specifically without the original police accident report. In several instances, the case files contained only a photocopy of the report, lacking an official stamp and signature from the authorities. This rendered the documents unverifiable and unreliable for validating compensation.

The audit noted that the absence of the original police report increases the risk of fraud, making it impossible to accurately verify the circumstances of the accident.

The report warns that this deficiency could lead to unjustified or unsubstantiated compensations, causing financial losses for the insurance company.

“Moreover, in the event of regulatory audits or legal challenges, the lack of complete documentation may result in penalties or adverse outcomes in judicial proceedings”, the report states.

Double compensation for the same accident

The internal audit report titled “Handling and Payment of Claims from January 2019 to June 2024” revealed mismanagement in several cases. In one instance, the Bureau made a double payment for the same motor vehicle accident.

The first payment for material damage was made on July 29, 2016, amounting to 15,809 euros to the injured party. A second payment was later made in the name of subrogation from the border insurance fund to the insurance company based in Switzerland, amounting to 35,954 euros on July 16, 2020. This subrogation payment was ordered in accordance with the decision of the Court of Appeals (Case No. 120/19, dated May 20, 2020).

“This action constitutes a breach of damage management protocols and insurance principles, as the Bureau should not issue double compensation for the same incident – especially since the injured party had already been compensated on March 5, 2016”, the audit report states.

The audit found that in nine cases of compensation for insured vehicles, the damage assessors at the Bureau did not conduct a physical inspection of the vehicles. Instead, they evaluated the damages solely based on photographs provided by the injured party. Furthermore, in 18 cases the damage report was not signed by the injured party, rendering the compensation process unverifiable and potentially vulnerable to errors.

In another instance, in 2021, a payment of 11,000 euros for material damage compensation was executed just three days before the finalization of an out-of-court settlement between the injured party and the Bureau.

“This procedural shortcut may pave the way for abuse and set a precedent for similar cases, undermining the transparency and control over the compensation process. In addition, the lack of a formal agreement could result in legal repercussions, exposing the Bureau to lawsuits or additional liabilities”, the report states.

Another finding reveals that two members of the same family were compensated 11,000 euros for non-pecuniary damages, while the out-of-court settlement had been concluded in the amount of 12,000 euros.

During the examination of the case, it was noted that essential documentation to support the basis of the compensation was missing. This includes a hospital report to confirm the physical and emotional consequences of the incident, an autopsy report from the forensic doctor to confirm the cause of death, and a death certificate, which should serve as the primary evidence for the claim.

The audit emphasizes that the lack of such crucial documentation undermines the legality and transparency of the compensation process, increasing the risk of unjustified or unsubstantiated payments. It warns that in the absence of important documents such as hospital reports, autopsy findings, and death certificates the Bureau may face legal challenges from involved parties and penalties from regulatory authorities for procedural violations.

This report also contains additional findings that reveal further mismanagement within the Bureau during the audited period.